November 15, 2024

By Steve Blumenthal

“It isn’t what we don’t know that gives us trouble; it’s what we know that ain’t so.”

– Will Rogers (November 4, 1879 – August 15, 1935)

Today, let’s put some hard numbers into play and then game theory the economic implications going forward. Inflation vs. disinflation: I find a number of arguments compelling. For example, Dr. Lacy Hunt is in the disinflation camp. I disagree, but really, who wants to go toe-to-toe with the G.O.A.T.?

In Hunt’s latest quarterly letter, he shares his belief that inflation and interest rates will likely keep dropping because the system has extra economic slack, and past interest rate hikes are still cooling things down. This gives the Federal Reserve room to cut interest rates further, which he says they’ll need to do to address weak money supply growth over recent years. As inflation continues to drop, long-term Treasury bond yields are also expected to decline–a trend Hunt says is supported by research. Globally, sluggish money supply growth is putting more pressure on Treasury yields to fall.

It’s hard to disagree with Lacy. However, I believe, as I wrote a few weeks ago, All Roads Lead to Inflation.

Below, I’ve briefly summarized the implications for the economy and financial markets.

Some key data points to start:

- US household debt is ~$18 trillion.

- Corporate debt is ~$11 trillion.

- State and local government debt is ~ $3 trillion.

- Federal government debt is ~$36 trillion.

- In total, the US has around $68 trillion in debt across households, corporations, and federal/state/local governments.

The main takeaways and implications for the economy and financial markets:

- This $68 trillion in total debt, with an average interest rate of 6%, results in the US spending around $4 trillion annually on interest payments alone.

- This means 15% of every dollar in the $29 trillion US economy (GDP) goes towards servicing the existing debt.

- The high level of leverage and debt-servicing costs are seen as a significant economic challenge for the US.

- More money will have to be used to cover the debt. Debt is good for the economy as it creates more money you can spend––until we reach the point where it has to be paid back. Then, less income is available to spend on other things, and less spending on things slows the economy.

Don’t worry, I hear you and agree: Fundamentally high debt is deflationary.

But, this significant structural issue for the US economy has wide-ranging implications. For one, the biggest debtor in the US has a very large printing machine, and it’s using it to fund the ~$2 trillion in annual government deficits. Will the deficit spending stop under Trump? Maybe. Not sure. Can we cut spending? No one is willing to vote on reducing Social Security and Medicare benefits.

Sadly, the high level of debt–and higher interest rates on that debt–is a global problem, not just a United States problem.

- The UK’s budget deficit is 4.4% of GDP, and its economy only grows 0.9% annually.

- France is struggling with a budget deficit of 6% of GDP and is raising taxes on large companies and high-income individuals to generate more revenue.

- Brazil also has a significant budget crisis, with high inflation and states owing $130 billion to the federal government.

- China, a major buyer of US Treasuries in the past, has been selling off its holdings in recent years, leaving the Federal Reserve as potentially the “buyer of last resort” for US debt.

- The only sane actor in the room appears to be Argentina’s Javier Milei. Their inflation pain was so extreme that the right guy–an economic hero–was elected to the job. Thankfully, the US is nowhere near Argentina’s pain point.

My base case is that we’ll continue to elect leadership that promises to give us more sugar. This will continue until we reach the point where we all realize that sugar is poison to the system. In other words, more inflation will provide the pain. I respect the sluggish money growth argument, but on the human behavioral side of this debate, I see continued can-kicking and money printing (sugar) until we’re all inflated and forced to change our diet.

The high global debt levels create significant fiscal challenges, leading to more money printing by central banks and higher inflation.

John Mauldin wrote about the debt mess in his weekly Thoughts from the Frontline missive titled One Way Road to Crisis (written before the election). From John:

The state of our fiscal union is terrible and getting worse. The Congressional Budget Office updated its Budget and Economic Outlook in June. CBO’s methodology has limitations, but I’ll stick with it for consistency, since I’ve cited it before.

CBO expects a FY 2025 budget deficit of almost $2 trillion, of which more than half is net interest. The debt owed to the public (i.e., excluding the Social Security and Medicare trust funds) will stand at $30.2 trillion when this fiscal year ends. That will represent 99% of GDP.

(USDebtClock.org pegs the deficit close to $36 trillion and 122% of GDP.)

By FY 2034, CBO’s outlook shows the debt will exceed $50 trillion, which will be 122.4% of GDP. At that point, we will be spending $1.7 trillion a year on interest alone.

These numbers are terrible but they’re actually optimistic. Start with the assumptions. CBO’s outlook is for 2.0% GDP growth in 2024 and 2025, then a steady 1.8% in 2026 and later years. By law, the agency can’t incorporate recessions into its outlook, though we all know they happen every few years. We should understand that 1.8% to be an average of recession years that are worse and boom years that are better. But the order in which those happen makes a giant difference.

Inflation matters, too. CBO assumes we have it licked, with the CPI growing 2.3% in 2025 and 2.2% thereafter. Their interest rate assumptions are similarly optimistic.

John’s conclusion:

Simpson-Bowles was the most serious effort at fiscal reform in recent memory since the balanced budget that was created by Clinton and Gingrich. Yet it went nowhere. While the majority of the bipartisan commission agreed on a plan, it also drew sizable opposition from both sides. This is something where a majority isn’t enough. You need a supermajority consensus. No such thing was possible in 2010, nor would it be today, in my opinion.

So where does that leave us? It leaves us on a one-way road to debt oblivion. This simply can’t continue. At some point this will be unmistakably clear. I think whoever we elect next week will be facing that fact by the end of their term.

Good luck to them. They will need it. (John penned his piece prior to the election)

I provide a summary of other arguments from thought leaders and successful macro investors whom I respect further below in the section titled “Stanley Druckenmiller, Ray Dalio, and Paul Tudor Jones.” You know their names. I find myself aligned with their thinking.

But before we go there, I want to compare and contrast my views with Lacy’s, and I hope it leads to a podcast with Lacy in the near future. We’d have a great discussion. Put your game theory hat on. Lacy is brilliant, and we should understand his reasoning.

Contrasting Economic Outlooks: Inflation vs. Disinflation

Blumenthal’s View: “All Roads Lead to Inflation”

- Core Thesis: The reliance on fiscal stimulus and monetary expansion to fund government spending, deficits, and entitlements is inherently inflationary.

- Waves of Inflation:

- Wave 1 (post-COVID) is behind us.

- Every whisper of a slowdown will find additional support from the fiscal and monetary authorities (the government and Federal Reserve, respectively). In other words, the sugar makers.

- Wave 2 (ahead) will be more substantial than Wave 1, driving inflation and interest rates higher.

- Structural Changes Ahead: By the latter half of the 2020s, inflationary pain will necessitate restructuring the debt and entitlements (e.g., “Bretton Woods Part II”) to anchor currency value. For now, the dollar rules.

- Implications: Persistent inflationary pressures will push Treasury yields higher, reflecting a need for tighter monetary policy to combat rising prices.

Dr. Lacy Hunt’s View: “The Case for Disinflation”

- Core Thesis: Contraction in global money supply (M) and low money velocity (V) create disinflationary forces.

- Monetary Contraction:

- Money supply growth surged during 2020–2022 but has since reversed sharply, signaling a prolonged downturn.

- The current contraction in money supply is more severe than during the Great Financial Crisis.

- Policy Lag: Changes in interest rates take time to affect economic activity, further delaying inflationary responses.

- Implications: Disinflation will dominate, with falling inflation and declining long-term Treasury yields, as central banks continue to ease policy to support sluggish growth.

Key Divergences

- Primary Driver:

- I emphasize structural government and policy-driven inflation.

- Dr. Hunt highlights cyclical monetary contraction and excess capacity.

- Outlook on Inflation:

- I foresee successive inflationary waves and eventual systemic reform.

- Dr. Hunt predicts persistent disinflation and sub trending economic growth.

- Bond Market:

- My view suggests rising Treasury yields due to inflation.

- Dr. Hunt anticipates declining yields as inflation recedes.

Neither of us discussed aging demographics, which we agree it is a deflationary force. AI? I believe it will displace many jobs, and the implications are wide-ranging. Put that on the deflationary side of the ledge.

This note from Apollo’s Torsen Stork paints the current picture well: US fiscal policy is on an unsustainable path.

I constantly think about the macroeconomic system—frankly, maybe too much. Of course, the goal is to better understand the short-term cyclical and long-term secular cycles and what they mean for investment positioning. Debt and entitlement issues sit front and center. How will we humans behave? We can make assumptions about the direction of the Fed. Chairman Powell’s term ends in May 2026, and his board post ends in January 2028. Who will lead? We don’t know. There are concerns about the Fed’s independence under Trump.

I have unending respect for my friend Dr. Lacy Hunt, but my view differs. I will reach out to him and invite him to a podcast. I’m focused on the ‘end of long-term debt cycle’ challenge that hasn’t occurred since the 1930s, and even further back, where, historically, nearly all indebted dominant empires debased their currencies. I don’t believe this time will be different, but I promise to channel my inner Will Rogers, challenging “what I know that ain’t so.” Stay tuned.

Grab your coffee and settle into your favorite chair. You’ll find a quick Druckenmiller, Dalio, and Jones summary update and a look at the 10-year treasury yield, gold, and the dollar. Inflation or deflation? Let’s keep our eyes on what the market is telling us. Finally, I share some commentary with you from this week’s Trade Signals post.

On My Radar:

- Stanley Druckenmiller, Ray Dalio, and Paul Tudor Jones

- 10-year Treasury Yield, Gold and the Dollar

- Trade Signals: November 13, 2024 Update

- Personal Note: It Was a Win and a Tasty IPA

See Important Disclosures at the bottom of this page. Reminder: This is not a recommendation to buy or sell any security. My views may change at any time. The information is for discussion purposes only.

If you like what you are reading, you can subscribe for free.

Stanley Druckenmiller, Ray Dalio, and Paul Tudor Jones

Druckenmiller: I’m worried the Fed declared victory on inflation too early.

Stanley Druckenmiller, a renowned investor, has recently expressed concerns regarding the Federal Reserve’s approach to inflation and interest rates:

Inflation Concerns:

- Premature Victory Declaration: Druckenmiller believes the Federal Reserve may have declared victory over inflation too soon. He points to tight credit spreads, record-high gold prices, and a robust equity market as indicators that inflation could resurge. Morningstar

- Historical Parallels: Drawing comparisons to the 1970s, he notes that inflation initially declined before rebounding, suggesting a similar pattern could emerge today. Yahoo Finance

Interest Rate Policy:

- Critique of Rate Cuts: Druckenmiller has criticized the Federal Reserve’s recent decision to cut interest rates by 50 basis points, arguing that such aggressive easing is unwarranted given current economic conditions. MarketWatch

- Advocacy for Caution: He emphasizes the importance of the Fed focusing on long-term economic stability rather than attempting to fine-tune short-term outcomes, cautioning against the risks of premature rate reductions. Yahoo Finance

Investment Strategy:

- Shorting U.S. Bonds: Reflecting his inflation concerns, Druckenmiller has taken short positions on U.S. government bonds, anticipating that inflationary pressures could lead to higher yields and lower bond prices.

- Cautious Equity Positioning: While acknowledging the strength of the equity market, he remains cautious, suggesting that current valuations may not fully account for potential inflationary risks. Star Tribune

In summary, Stanley Druckenmiller warns that the Federal Reserve’s recent actions may be premature, potentially leading to a resurgence in inflation. He advocates a more cautious approach to interest rate policy and has adjusted his investment strategies accordingly. Yahoo Finance

10-year Treasury Yield, Gold and the Dollar

This chart plots the yield on the 10-year Treasury. The current yield is 4.45%, up over 80 bps from the 3.64% low in September. What is unusual is that the jump occurred after the Fed cut rates 50 bps in September. The market is seeing inflation. The Fed cut rates another 25 bps in November, and the yield on the 10-year again moved higher.

Keep an eye on what the market signals, not what the Fed tells us.

What I like about this chart is the MACD indicator in the lower section. It is a trend signal and does a good job (not perfect) of identifying the intermediate-term trend. Red arrows signal rising interest rates, and green arrows signal declining interest rates. I included the yellow zone in the middle of the chart months ago. My guess was where rates may go when we have the next recession. Recession remains elusive.

Source: Stockcharts.com

Gold’s in an expected correction. The Weekly MACD is in a bear-trend signal (red arrow lower right-hand section). My two cents is a correction to the 2400 – 2500 price level, which is probable. I remain long-term bullish on gold. Not a specific recommendation for you to buy or sell any security. Talk with your advisor.

Source: Stockcharts.com

Source: Stockcharts.com

The dollar is higher, with interest rates higher. The MACD is in a bull signal (green arrow).

Source: Stockcharts.com

Market Commentary:

We have completed the back end of inflation wave number one, and wave two begins. Powell is easing, and with the 10-year Treasury yield up over 60 bps since the Fed cut rates 50 bps in September (and another 25 bps in November), the bond market is telling him he is wrong.

Mohamad El-Erian, writing on X, quoting John Authers (Source),

“I am a big fan of John Authers’ daily note on Bloomberg Opinion. I always find it insightful, and today is no exception. John’s detailed analysis of yesterday’s US CPI data leads him to write that: “Inflation in the US has definitely stopped going down.” “…services — where salaries tend to be a particularly strong driver of prices — remain problematic.” “The various specialist statistical measures drawn up by different teams of economists within the Fed confirm that inflation remains above 3% (the top of the Fed’s targeted range) and is no longer clearly declining.” Meanwhile, markets will be watching closely Fed Chair Powell’s remarks later today, including whether he re-iterates his view that the world’s most powerful central bank “has gained confidence that we’re on a sustainable path to 2%.” What he is very unlikely to do is discuss whether 2% remains the right inflation target for an economy undergoing so many structural changes. And this is before you take any view on what’s ahead policy-wise.”

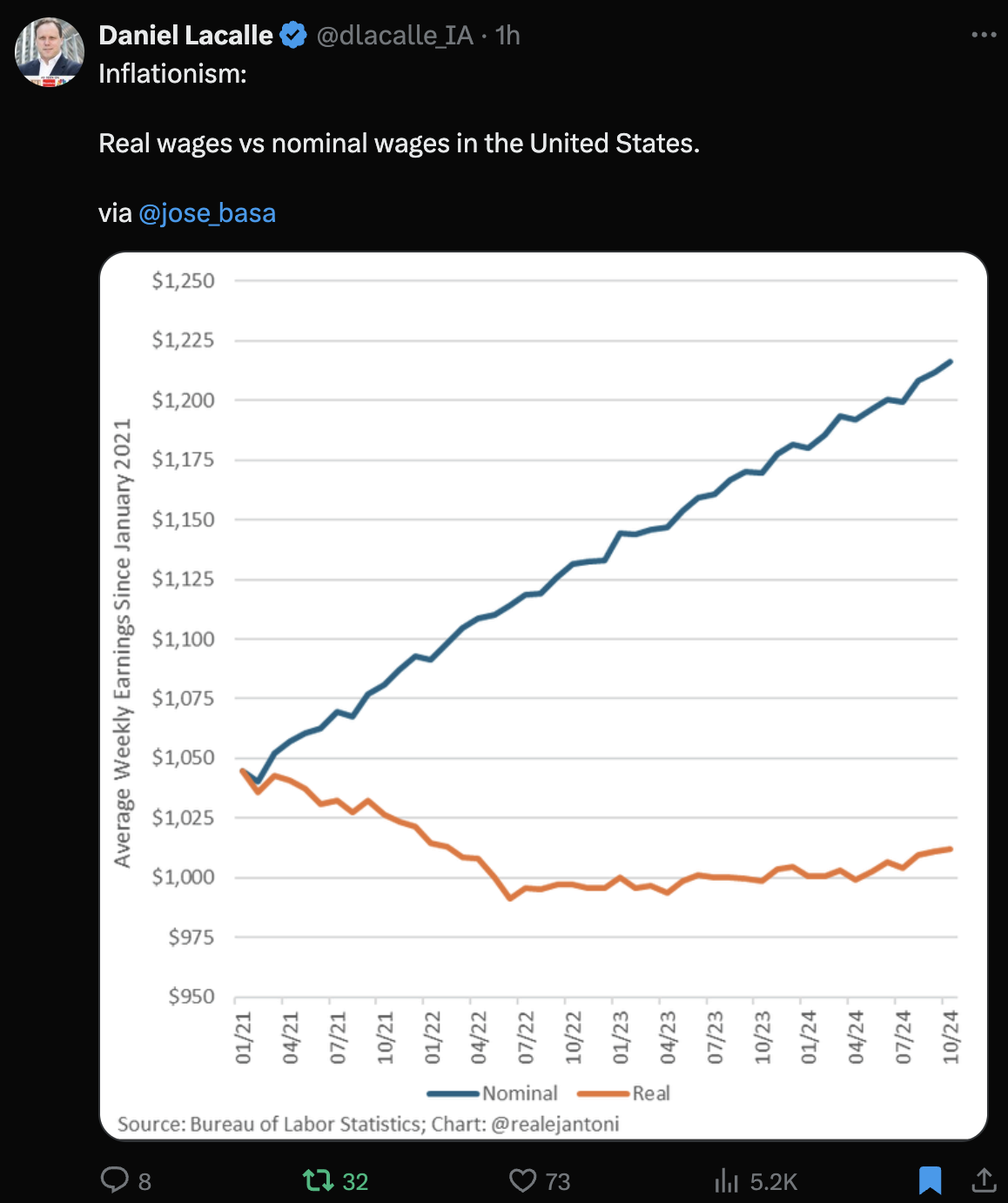

The following chart plots the real problem. Look how wages (blue line) have risen, yet wage earners’ dollars don’t buy them as much when higher inflation is factored in (orange line).

Source: @dlacalle_IA, Bureau of Labor Statistics: @realejantoni

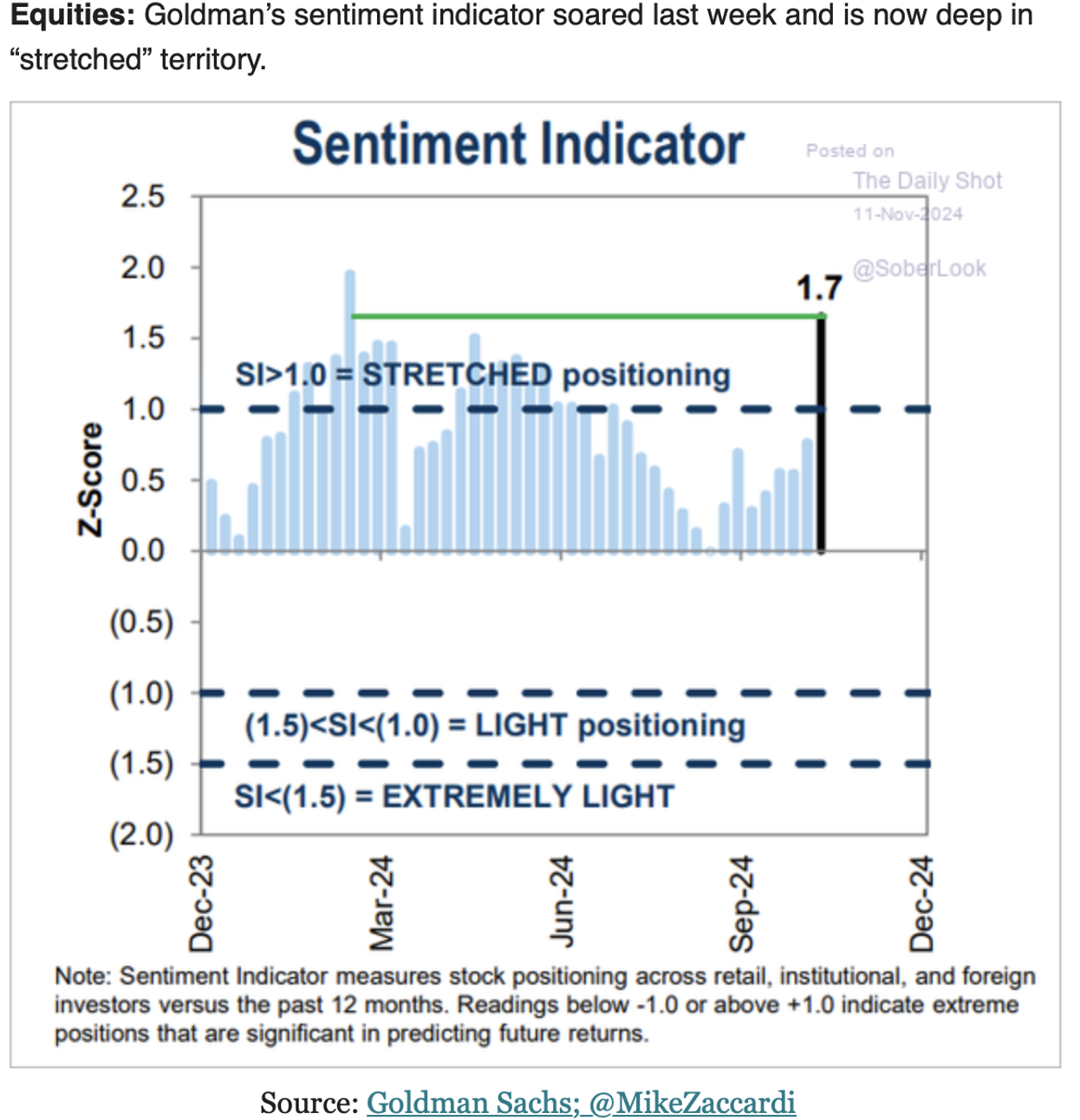

The equity market is at an all-time high, valuations are near record highs, and the trend indicators remain bullish. It sure feels like euphoria. There is a reason Warren Buffett has nearly 1/3rd of his money in short-term cash alternatives. Both weekly sentiment charts I share with you flash extreme optimism (find them in the sentiment section below). The following data point is from Goldman Sacs:

The dashboard of indicators, along with the updated charts, is below.

Please reach out to me if you have any questions at steve@cmgwealth.com.

In Trade Signals, we combine a fundamental view with our arsenal of technical indicators to help with investment entry points and risk management.

If you are not a subscriber and would like a sample, reply to this email, and we’ll send you a sample.

Trade Signals is designed for traders and investors seeking a better understanding of macro trends. Click on the link below to subscribe or log in. The letter is free for CMG clients.

TRADE SIGNALS SUBSCRIPTION ACKNOWLEDGEMENT / IMPORTANT DISCLOSURES

The views expressed herein are solely those of Steve Blumenthal as of the date of this report and are subject to change without notice. Not a recommendation to buy or sell any security.

Personal Note: It Was a Win and a Tasty IPA

“The secret is to show up, do the work, and go home.

A blue-collar work ethic married to indomitable will. It is literally that simple.

– Coach Sommer

A quick thank you for the many emails asking about the results from last week’s final Friar soccer game. It was an important one for Coach Sue and the team, and I enjoyed it as well. The boys won the game 3-1, giving them a season-end record of 10 wins, 7 losses, and 4 ties. And yes, the cold IPAs were excellent. It was a Troeg’s Blizzard of Hops IPA for Coach Sue and a Workhorse West Coast IPA for me.

Speaking of sports, I came across a post on X from @KennyD21m sharing an email from former US National Gymnastics coach Chris Sommer to entrepreneur and investor Tim Ferriss, @tferriss.

X user Kenny D said he keeps a printed version on his desk. I may do the same. This email speaks to the lesson that having the discipline to keep going when others quit may be the most significant thing sports teach us about life. Please share it with your children and grandchildren if you like it.

The season-ending banquet is on Sunday. I’m very much looking forward to it. Susan is putting her speech together. To say she pours her heart into it is an understatement. Congrats to the Friars and my beautiful wife.

I was in Florida this week––a big hat tip to my friend and host Andy McOrmond. The weather was excellent, and yes, I snuck some golf in Tuesday afternoon. Here’s a picture from the course. Andy took my money and John saved the day on our team bet.

Scott, Andy, Steve, and John (West Palm Beach, FL)

Thanksgiving is approaching, and all the kids are coming home. Yahoo to that!

Raise your cold IPA high in the air; here’s a toast to a blue-collar work ethic married to indomitable will and a lot of patience to go with it!

All the best to you and yours.

Ever forward!

Steve

You can share this letter on X by clicking here.

You can share this letter on LinkedIn by clicking here.

Subscribe to OMR for free by clicking the photo.

Stephen B. Blumenthal

Executive Chairman & CIO

CMG Capital Management Group, Inc.

Private Wealth Client Website – www.cmgprivatewealth.com

TAMP Advisor Client Webiste – www.cmgwealth.com

Forbes Book – On My Radar, Navigating Stock Market Cycles. Stephen Blumenthal gives investors a game plan and the advice they need to develop a risk-minded and opportunity-based investment approach. It is about how to grow and defend your wealth. You can learn more here.

Stephen Blumenthal founded CMG Capital Management Group in 1992 and serves today as its Executive Chairman and CIO. Steve authors a free weekly e-letter entitled, “On My Radar.” Steve shares his views on macroeconomic research, valuations, portfolio construction, asset allocation and risk management.

Follow Steve on Twitter @SBlumenthalCMG and LinkedIn.

IMPORTANT DISCLOSURE INFORMATION

This document is prepared by CMG Capital Management Group, Inc. (“CMG”) and is circulated for informational and educational purposes only. There is no consideration given to the specific investment needs, objectives, or tolerances of any of the recipients. Additionally, CMG’s actual investment positions may, and often will, vary from its conclusions discussed herein based on any number of factors, such as client investment restrictions, portfolio rebalancing, and transaction costs, among others. Recipients should consult their own advisors, including tax advisors, before making any investment decision. This material is for informational and educational purposes only and is not an offer to sell or the solicitation of an offer to buy the securities or other instruments mentioned. This material does not constitute a personal recommendation or take into account the particular investment objectives, financial situations, or needs of individual investors which are necessary considerations before making any investment decision. Investors should consider whether any advice or recommendation in this research is suitable for their particular circumstances and, where appropriate, seek professional advice, including legal, tax, accounting, investment, or other advice. The views expressed herein are solely those of Steve Blumenthal as of the date of this report and are subject to change without notice.

Investing involves risk.

This letter may contain forward-looking statements relating to the objectives, opportunities, and future performance of the various investment markets, indices, and investments. Forward-looking statements may be identified by the use of such words as; “believe,” anticipate,” “planned,” “potential,” and other similar terms. Examples of forward-looking statements include, but are not limited to, estimates with respect to financial condition, results of operations, and success or lack of success of any particular market, index, investment, or investment strategy. All are subject to various factors, including, but not limited to, general and local economic conditions, changing levels of competition within certain industries and markets, changes in legislation or regulation, Federal Reserve policy, and other economic, competitive, governmental, regulatory, and technological factors affecting markets, indices, investments, investment strategy and portfolio positioning that could cause actual results to differ materially from projected results. Such statements are forward-looking in nature and involve a number of known and unknown risks, uncertainties, and other factors, and accordingly, actual results may differ materially from those reflected or contemplated in such forward-looking statements. Investors are cautioned not to place undue reliance on any forward-looking statements or examples. All statements made herein speak only as of the date that they were made. Investing is inherently risky and all investing involves the potential risk of loss.

Past performance does not guarantee or indicate future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product (including the investments and/or investment strategies recommended or undertaken by CMG), or any non-investment related content, made reference to directly or indirectly in this commentary will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation or prove successful. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this commentary serves as the receipt of, or as a substitute for, personalized investment advice from CMG. Please remember to contact CMG, in writing, if there are any changes in your personal/financial situation or investment objectives for the purpose of reviewing/evaluating/revising our previous recommendations and/or services, or if you would like to impose, add, or to modify any reasonable restrictions to our investment advisory services. Unless, and until, you notify us, in writing, to the contrary, we shall continue to provide services as we do currently. CMG is neither a law firm, nor a certified public accounting firm, and no portion of the commentary content should be construed as legal or accounting advice.

No portion of the content should be construed as an offer or solicitation for the purchase or sale of any security. References to specific securities, investment programs or funds are for illustrative purposes only and are not intended to be, and should not be interpreted as recommendations to purchase or sell such securities.

This presentation does not discuss, directly or indirectly, the amount of the profits or losses realized or unrealized, by any CMG client from any specific funds or securities. Please note: In the event that CMG references performance results for an actual CMG portfolio, the results are reported net of advisory fees and inclusive of dividends. The performance referenced is that as determined and/or provided directly by the referenced funds and/or publishers, has not been independently verified, and does not reflect the performance of any specific CMG client. CMG clients may have experienced materially different performance based upon various factors during the corresponding time periods. See in links provided citing limitations of hypothetical back-tested information. Past performance cannot predict or guarantee future performance. Not a recommendation to buy or sell. Please talk to your advisor.

Information herein has been obtained from sources believed to be reliable, but we do not warrant its accuracy. This document is general communication and is provided for informational and/or educational purposes only. None of the content should be viewed as a suggestion that you take or refrain from taking any action nor as a recommendation for any specific investment product, strategy, or other such purposes.

In a rising interest rate environment, the value of fixed-income securities generally declines, and conversely, in a falling interest rate environment, the value of fixed-income securities generally increases. High-yield securities may be subject to heightened market, interest rate, or credit risk and should not be purchased solely because of the stated yield. Ratings are measured on a scale that ranges from AAA or Aaa (highest) to D or C (lowest). Investment-grade investments are those rated from highest down to BBB- or Baa3.

NOT FDIC INSURED. MAY LOSE VALUE. NO BANK GUARANTEE.

Certain information contained herein has been obtained from third-party sources believed to be reliable, but we cannot guarantee its accuracy or completeness.

In the event that there has been a change in an individual’s investment objective or financial situation, he/she is encouraged to consult with his/her investment professional.

Written Disclosure Statement. CMG is an SEC-registered investment adviser located in Malvern, Pennsylvania. Stephen B. Blumenthal is CMG’s founder and CEO. Please note: The above views are those of CMG and its CEO, Stephen Blumenthal, and do not reflect those of any sub-advisor that CMG may engage to manage any CMG strategy, or exclusively determines any internal strategy employed by CMG. A copy of CMG’s current written disclosure statement discussing advisory services and fees is available upon request or via CMG’s internet web site at www.cmgwealth.com/disclosures. CMG is committed to protecting your personal information. Click here to review CMG’s privacy policies.