February 16, 2024

By Steve Blumenthal

“Sustainable bull markets don’t start with a Shiller P/E of 33 and full employment.”

– Jeremy Grantham, GMO

Several observations on the current technical picture of the US stock and bond markets: overvalued, overbought, and over believed…

The top five stocks in the S&P 500 Index—Microsoft, Apple, Alphabet, Amazon, and Nvidia—makeup 25% of the Index. Compare that to the top five stocks in 2000—Microsoft, GE, Cisco, Intel, and Exxon—which made up approximately 18% of the Index. If we go further back to the Nifty Fifty peak in 1972, the top five stocks—then IBM, AT&T, Exxon, Eastman Kodak, and GM—made up approximately 24% of the S&P 500 Index. Source: @WinfieldSmart

Let’s zoom out to put these values into perspective. The total market cap of the S&P 500 Index is $42 trillion. The total market cap of the entire US stock market is approximately $51 trillion. And the total Global Stock Market (in 2023), according to Visual Capitalist, is at $109 trillion.

The top five stocks of the $42 trillion S&P 500 Index total equals $10.5 trillion. That’s 21% of the total US stock market and 10% of the total Global Stock Market. Those are high percentages, which means that we need to look at concentration risk—more on that in a second.

First, you may find the following chart from Visual Capitalist interesting, as I did:

Source: Visual Capitalist

Back to the concentration issue. So much of the market is concentrated among very few companies. Compare the current high concentration to those earlier periods mentioned above, and we see the same level of bullishness at the top of the Tech Bubble in 2000 and in the Nifty Fifty years in the early 1970s.

Grab some popcorn, friend. We are well past intermission, and the movie is really getting interesting.

Here’s a look at the Top 5 by Market Cap in the S&P 500 Index over time (hat tip to Win Smart and The Daily Shot):

Bottom line: Bullishness is off the charts. As you’ll see in the Random Tweets section below, the number of weekly increases in the S&P 500 is the most overextended it’s been in 50 years, and consensus bulls now match the highest level in 20 years. Allow me to reiterate today’s intro quote by Jeremy Grantham: “Sustainable bull markets don’t start with a Shiller P/E of 33 and full employment.”

Further, quoting the great Sir John Templeton, “Bull markets are born on pessimism, grow on skepticism, mature on optimism and die of euphoria.”

It didn’t feel like euphoria when the S&P 500 was at 3,500 in 2022; fear was at an extreme. And today, at 5,000, there’s no fear. “Soft landing” has turned to no landing, and Google searches for “call options” have soared to record highs. It’s the fear-and-greed cycle in its truest form. I’d be shocked if we weren’t near a market top; though, admittedly, I’ve been shocked before. Anticipating human behavior is challenging. If this isn’t a “sell when everyone is buying” moment, I don’t know what is.

Grab your coffee and find your favorite chair. My friend Ben Hunt tells it like it is in his latest Epsilon Theory brief, which provided the inspiration for this week’s OMR title: We Are Getting Played (…by Washington and Wall Street, that is). It’s a quick, witty, and interesting read. Also, I tuned into a YouTube roundtable discussion featuring Jeffrey Gundlach and Jeffrey Sherman from DoubleLine Capital, Jim Bianco of Bianco Research, David Rosenberg of Rosenberg Research, author and Fox Business anchor Charles Payne, and Danielle DiMartino Booth, CEO of Quill Intelligence. You’ll find a few of my quick takeaways and a discussion link below.

On My Radar:

- The Washington Pravda and the Wall Street Izvestia, by Ben Hunt

- Macro Discussion – Gundlach, Sherman, Rosenberg, Bianco, DiMartino Booth and Payne

- Random Tweet’s

- Personal Note: Atlanta and Park City

- Trade Signals: Weekly Update, February 14, 2024

(Reminder: This is not a recommendation to buy or sell any security. My views may change at any time. The information is for discussion purposes only.)

If you are not signed up to receive the free weekly On My Radar letter, subscribe here.

The Washington Pravda and the Wall Street Izvestia, by Ben Hunt

Back in the day, Pravda was the official newspaper of the Soviet Communist Party and Izvestia was the official newspaper of the Soviet government. They were, in the lingo of these matters, “organs” of the Soviet Union. Today Pravda is the official newspaper of the Russian Communist Party and Izvestia, self-described as a “Russian national newspaper”, is owned by Gazprom. LOL.

Speaking of the Soviet Union, I’m old enough to remember when a sclerotic and failing Leonid Brezhnev was the perfect symbol of the sclerotic and failing USSR, when the advanced age and decrepitude of Soviet leadership was a global joke. Wanna guess how old Brezhnev is in this photo, taken two years before his death? He’s 73.

Anyhoo …

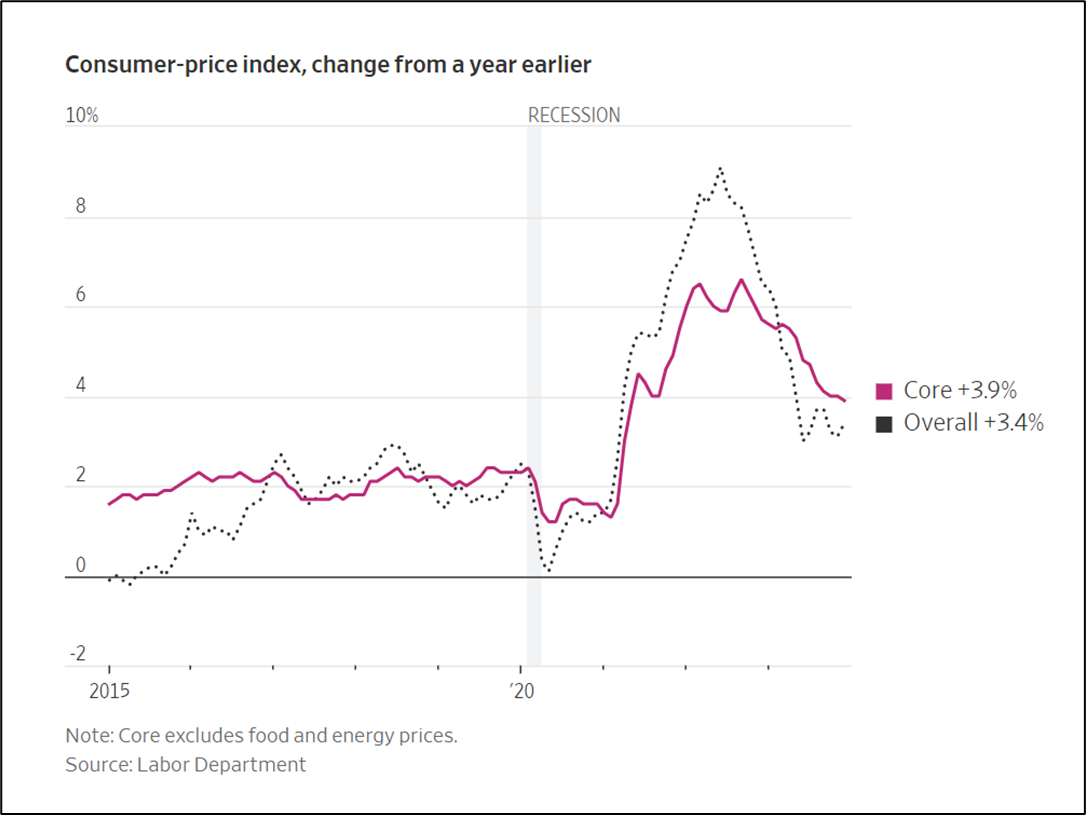

Last month I wrote a note about media framing of the monthly CPI release. The point was that the Wall Street Izvestia was altering its graphical presentation of CPI reports to encourage the perception that inflation rates were continuing to fall rapidly as opposed to flatlining over the past six months. Money quote from Non-Linguistic Inflation Framing in the Wall Street Journal:

Today both Wall Street and the White House are determined to tell you a story that inflation is over, mission accomplished. Wall Street because they want a cheaper price of money and the White House because they want to win an election.

It’s not a lie, per se, but it’s not a truth, either. It’s all just story, all the way down, not just in their words but in their pictures, too.

For the past year, since March 2023, the WSI has graphically emphasized the core inflation rate, officially because everyone knows that everyone knows that core inflation is what you should really be paying attention to and overall inflation is for chumps, truthfully because core inflation rates have continued to decline since last June and so present a Narrative-appropriate picture, as opposed to overall inflation rates which bottomed out last summer. The presentation emphasizing core inflation looks like this from a month ago, with a dark red line for core inflation and a faint dotted line for overall inflation:

Jan 11, 2024: WSJ – Inflation Edged Up in December After Rapid Cooling Most of 2023

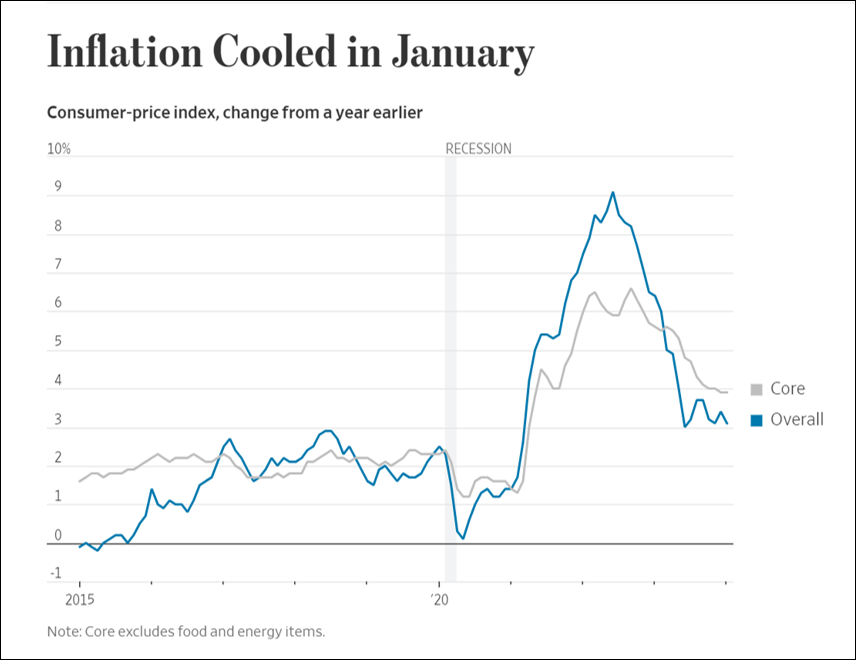

Honestly, I didn’t think that it was possible for the WSI to outdo themselves on this score with yesterday’s coverage of the CPI release, but well … here we are. Yesterday, when core inflation rates flattened and overall rates ticked down, the WSI reversed course and graphically emphasized overall inflation to justify the narrative-appropriate “Inflation Cooled in January” headline.

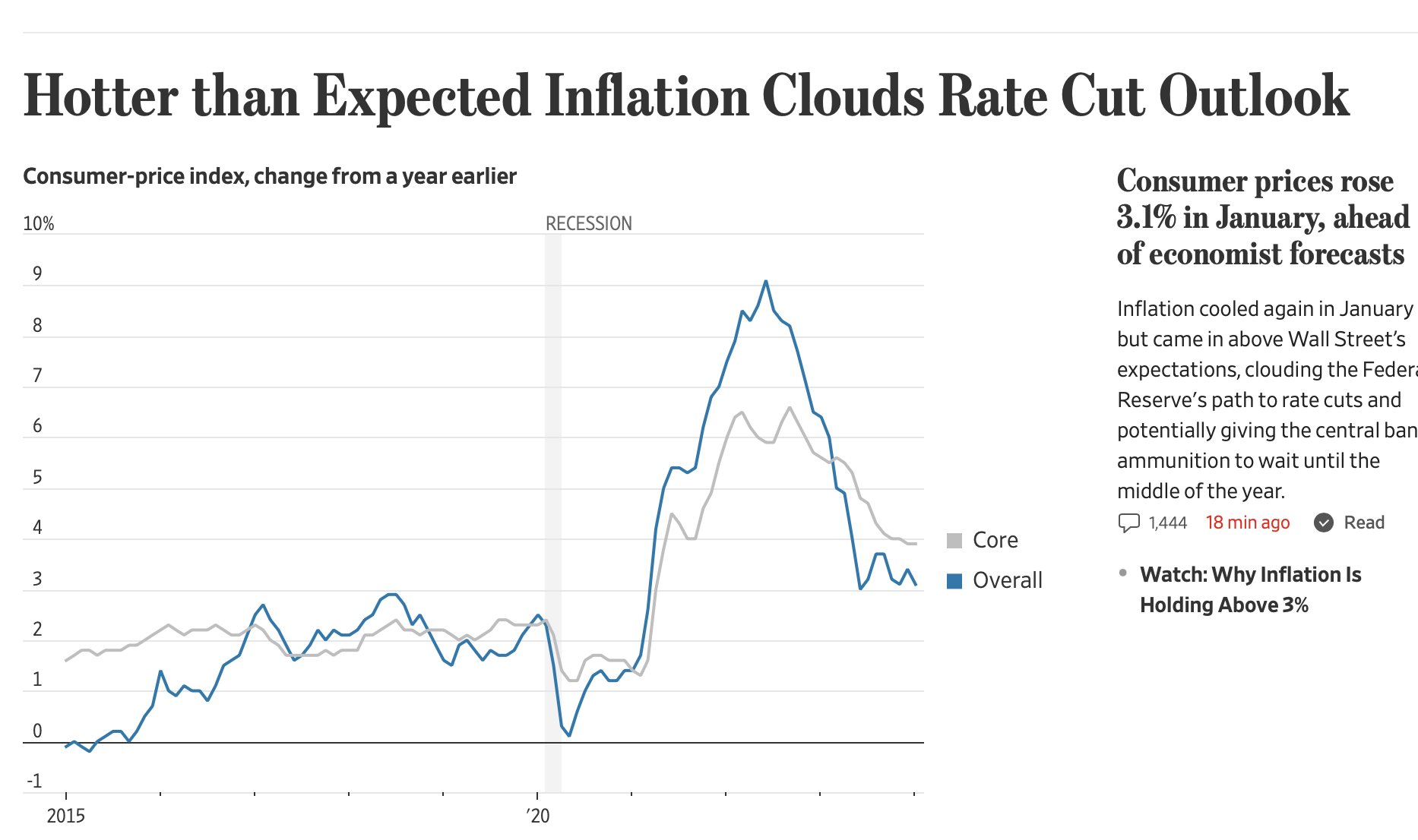

I took this as a screenshot soon after the 8:30 am data release, but I don’t think you can find this headline on the WSI today. Once markets tanked and the Prime Directive of financial news media kicked in – must provide the WHY for a market move – the WSI editors replaced “Inflation Cooled in January” with “Hotter than Expected Inflation Clouds Rate Cut Outlook.”

But do not fret, gentle reader! Yesterday’s inflation concerns can be safely ignored, as WSI opinion leaders are only too happy to inform you this morning.

At least the Wall Street Izvestia is forced to respond to market realities in its efforts at Nudge.

For the Washington Pravda it’s all Fiat News all the time, where your reality is always declared to you and never actually lived.

And no, this isn’t just a case of an over-zealous headline writer. Here’s the first line of text: “Prices cooled further in January, offering the latest sign that inflation has eased significantly since its pandemic-era surge”.

I’d say that you literally can’t make this up, but in fact, it was literally made up. Pure MiniPlenty language. Not a lie, per se, but also not a truth. Or at least not the truth that matters: inflation is well embedded at a point well above the Fed’s target.

Is this a terribly inconvenient truth for Wall Street and the White House? Of course, it is, and rest assured that every possible data point going forward will be interpreted and massaged to fit the desired storybook ending of multiple rate cuts in 2024.

But for those of us who have to live and invest in the real world, it’s never been more important to see the story-telling effort with Clear Eyes.

A big thank you to Ben!

You can subscribe to Ben’s Epsilon Theory research here.

Macro Discussion – Gundlach, Sherman, Rosenberg, Bianco, DiMartino Booth and Payne

A few quick bullet point highlights:

Here are a few bullet-point highlights from the roundtable:

- Jeffrey Gundlach believes interest rates have bottomed out and are likely to rise, which could lead to increased volatility in the market and problems for companies with high levels of debt. He noted that real interest rates have historically moved in a long-term trend, with cycles lasting around 40 years, and that the current rise in interest rates is part of this trend, which could have significant consequences for the economy.

- David Rosenberg predicts we’ll see a recession and that the Fed Funds rate will move down to 2.5% from its current level of 5%.Gundlach agrees it will likely go lower and predicts a 75% probability for a 2024 recession. Ultimately, he believes the low has happened, and interest rates are in a long-term upcycle. High single digits on the 10-year yield are likely.

- Rising interest rates may lead to increased volatility in the economy and markets, potentially defaulting marginal companies.

- Gundlach thinks inflation is a monetary phenomenon, which people have forgotten due to having trillions of dollars injected into the economy.

- Presently, unemployment is under 4%, and yet the deficit has been increasingbecause of higher interest rates—partially because $17 trillion in treasury bonds comes due in the next three to six months. The bonds’ average interest rate is well below today’s interest rates. A lot of them are at 50 basis points. And if you have to reinvest them at 4%, you have an arithmetic problem.

- Gundlach discussed how in recessions going back to 1969, the deficit has increased by an average of 5% of the The last three recessions got sequentially worse—you might want to discount 2020 because of that recession’s unusual circumstances, but during the Great Financial Crisis, the debt deficit increased by 9% of GDP. We’re running at more than 6% of GDP now, and there’s every reason to believe that, in a recession, we could reach a deficit increase of 12% of GDP. That’s not even being conservative.

- The real kicker is, if we reach a 12% GDP deficit and stay there, and if interest rates are at 6%, then the interest expense, as a percentage of total tax receipts, will go up to 80%. That would be impossible to deal with and simply cannot happen.

- Gundlach believes Jay Powell should be less dogmatic about the inflation target and more concerned about the solvency of the entire financial system.

- Some of these assumptions can be challenged, of course, but we’re already in a place of concern.

Topics include:

- (1:08) – How the US avoided recession despite numerous recessionary indicators and evidence the economy is far more downbeat than some widely followed economic statistics would indicate

- (10:57) – The condition of consumer and household financial conditions and the rapid rise of consumer borrowing delinquencies

- (15:50) – Possible factors behind the protracted length of the current cycle, including money supply as measured by M2, and as Charles Payne points out (27:58), the velocity of money

- (30:45) – Post-2020 transformations of the economy—the biggest being, as Jim Bianco notes, remote work and acceleration of deglobalization, with important implications for inflation

- (35:52) – Federal Reserve monetary policy, including Fed Chair Jerome Powell’s dovish pivot on 13, which Danielle DiMartino Booth thinks was timed “to get in front of the Iowa caucuses”

- (45:50) – The probability of recession in 2024

- (50:11) – Jeffrey Gundlach’s warning about the combination of the federal government running large deficits funded by debt amidrising interest rates, and despite low unemployment, and his outlook on the inevitability of a restructuring of the federal debt and the unfunded liabilities of American entitlement programs

Put your sneakers on and earbuds in and head out for a nice walk—or do what I do and play it via Bluetooth in my car. It’s really worth a listen.

Click on the photo to link to the full discussion.

(Reminder: This is not a recommendation to buy or sell any security. My views may change at any time. The information is for discussion purposes only.)

If you are not signed up to receive the free weekly On My Radar letter, subscribe here.

Random Tweet’s

The financial hits go well beyond the wealthy CRE office building landlords:

Source: Bloomberg

Level of investor bullishness matching 20-year high:

Call options: “… one would think it’s not professional asset managers looking this up.” Goldman Sachs:

The number of weekly increases in the S&P 500 is the most overextended it has been in 50 years.

You can follow me on X (formerly Twitter) @SBlumenthalCMG.

Not a recommendation to buy or sell any security. For discussion purposes only. Current viewpoints are subject to change.

If you are not signed up to receive the free weekly On My Radar letter, subscribe here.

Personal Note: Atlanta and Park City

Let me conclude by touching on today’s PPI inflation data. As the CPI did earlier this week, PPI data ticked higher. Keep your eyes on the 10-year Treasury Yield. It’s bumping back up to 4.30%, and is at a point of resistance (dotted orange line in the graph below). A break above puts the upper 4% yield range back in play.

Jeffrey Gundlach made a comment in his discussion that the US has more unfunded liabilities than it has assets. I went to the debtclock.org site for updated numbers and found that the total US unfunded liabilities have reached approximately $213 trillion vs. total assets of approximately $189 trillion. If this were your brokerage account, you’d be sent a margin call or liquidated, no questions asked.

I think we’re about to have a crisis-induced “come to Jesus” moment, wherein we have to craft a plan to restructure Social Security and Medicare, cut spending, and increase taxes. It will likely involve more money printing and monetizing a portion of the debt, which will, in turn, mean more inflation and, thus, higher interest rates. You can see how the hole becomes difficult to climb out of. Do you remember Laurel and Hardy? Time and again, Hardy says to Laurel, “Well, here’s another fine mess you got me in.” It kind of feels like that. But worse.

Could we see a debt jubilee? Maybe—but not without challenges. One person’s debt is another’s asset. And this is a global developed world problem. It’s leading us to a number of stress points for the US, Europe, and China… and the balance of the world. How each nation solves its problems impacts each of the other nation’s currencies, trade, and asset prices. If it’s a debt forgiveness jubilee (which I do not want), The US, Europe, and China will need to hold hands and sing Kumbaya together. That seems unlikely.

So, how can inflation, rising interest rates, or debt write-offs be good for an economy? At some point, the system must reset. I still believe we won’t see a reset until the second half of this decade. But that assessment is simply my current thesis – my best guess is the odds are certainly greater than 60%. That’s our current situation. Keep your defense on the field.

I fly to Atlanta on Sunday morning for an investment conference, and my weather app tells me the high will be 53 degrees. The app also showed me that it’s snowing again in Utah. The snow forecast put a smile on my face.

Speaking of Utah, our family had a wonderful ski trip. The atmospheric river rainstorm that pounded California moved east and dropped over four feet of snow in seven days on us in Snowbird. We had powder up to our waste in some of our favorite ski areas (for Snowbird fans: Bookends and Powder Paradise in Mineral Basin, Hoopies off of Road to Provo, and the Cirque)—as many deep powder ski days as I can remember ever having. Very lucky.

Spirits remain high, and how couldn’t they be? I’ve got another trip west coming up in early March for the annual WallachBeth Winter Symposium in Park City, Utah. I’m really looking forward to it. More powder snow, please!

I hope this note finds you with fun plans in your immediate future, too. Don’t stress about the markets; there is much you can do. Focus on protecting your CORE wealth and seek aggressive, risk-on opportunities for the EXPLORE portion of your wealth. As a general rule, I favor 80% CORE, and 20% EXPLORE, but it really is different for each person. Learn more about How We Think About Wealth here.

Have a wonderful week,

Steve

Trade Signals: Weekly Update – February 14, 2024

“Extreme patience combined with extreme decisiveness. You may call that our investment process. Yes, it’s that simple.”

– Charlie Munger

Each week, we update our dashboard of indicators covering stock, bond, developed, and emerging markets, along with the dollar and gold charts. We monitor inflation and recession as well.

If you are not a subscriber and would like a sample, reply to this email, and we’ll send you a sample.

The letter is free for CMG clients. It is designed for traders and investors seeking a better understanding of the current macro trends. You can SUBSCRIBE or LOGIN by clicking on the link below.

TRADE SIGNALS SUBSCRIPTION ACKNOWLEDGEMENT / IMPORTANT DISCLOSURES

The views expressed herein are solely those of Steve Blumenthal as of the date of this report and are subject to change without notice. Not a recommendation to buy or sell any security.

With kind regards,

Steve

Stephen B. Blumenthal

Executive Chairman & CIO

CMG Capital Management Group, Inc.

Private Wealth Client Website – www.cmgprivatewealth.com

TAMP Advisor Client Webiste – www.cmgwealth.com

If you are not signed up to receive the free weekly On My Radar letter, you can sign up here. Follow me on Spotify, Twitter @SBlumenthalCMG, and LinkedIn.

Forbes Book – On My Radar, Navigating Stock Market Cycles. Stephen Blumenthal gives investors a game plan and the advice they need to develop a risk-minded and opportunity-based investment approach. It is about how to grow and defend your wealth. You can learn more here.

Stephen Blumenthal founded CMG Capital Management Group in 1992 and serves today as its Executive Chairman and CIO. Steve authors a free weekly e-letter entitled, “On My Radar.” Steve shares his views on macroeconomic research, valuations, portfolio construction, asset allocation and risk management.

Follow Steve on Twitter @SBlumenthalCMG and LinkedIn.

IMPORTANT DISCLOSURE INFORMATION

This document is prepared by CMG Capital Management Group, Inc. (“CMG”) and is circulated for informational and educational purposes only. There is no consideration given to the specific investment needs, objectives, or tolerances of any of the recipients. Additionally, CMG’s actual investment positions may, and often will, vary from its conclusions discussed herein based on any number of factors, such as client investment restrictions, portfolio rebalancing, and transaction costs, among others. Recipients should consult their own advisors, including tax advisors, before making any investment decision. This material is for informational and educational purposes only and is not an offer to sell or the solicitation of an offer to buy the securities or other instruments mentioned. This material does not constitute a personal recommendation or take into account the particular investment objectives, financial situations, or needs of individual investors which are necessary considerations before making any investment decision. Investors should consider whether any advice or recommendation in this research is suitable for their particular circumstances and, where appropriate, seek professional advice, including legal, tax, accounting, investment, or other advice. The views expressed herein are solely those of Steve Blumenthal as of the date of this report and are subject to change without notice.

Investing involves risk.

This letter may contain forward-looking statements relating to the objectives, opportunities, and future performance of the various investment markets, indices, and investments. Forward-looking statements may be identified by the use of such words as; “believe,” anticipate,” “planned,” “potential,” and other similar terms. Examples of forward-looking statements include, but are not limited to, estimates with respect to financial condition, results of operations, and success or lack of success of any particular market, index, investment, or investment strategy. All are subject to various factors, including, but not limited to, general and local economic conditions, changing levels of competition within certain industries and markets, changes in legislation or regulation, Federal Reserve policy, and other economic, competitive, governmental, regulatory, and technological factors affecting markets, indices, investments, investment strategy and portfolio positioning that could cause actual results to differ materially from projected results. Such statements are forward-looking in nature and involve a number of known and unknown risks, uncertainties, and other factors, and accordingly, actual results may differ materially from those reflected or contemplated in such forward-looking statements. Investors are cautioned not to place undue reliance on any forward-looking statements or examples. All statements made herein speak only as of the date that they were made. Investing is inherently risky and all investing involves the potential risk of loss.

Past performance does not guarantee or indicate future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product (including the investments and/or investment strategies recommended or undertaken by CMG), or any non-investment related content, made reference to directly or indirectly in this commentary will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation or prove successful. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this commentary serves as the receipt of, or as a substitute for, personalized investment advice from CMG. Please remember to contact CMG, in writing, if there are any changes in your personal/financial situation or investment objectives for the purpose of reviewing/evaluating/revising our previous recommendations and/or services, or if you would like to impose, add, or to modify any reasonable restrictions to our investment advisory services. Unless, and until, you notify us, in writing, to the contrary, we shall continue to provide services as we do currently. CMG is neither a law firm, nor a certified public accounting firm, and no portion of the commentary content should be construed as legal or accounting advice.

No portion of the content should be construed as an offer or solicitation for the purchase or sale of any security. References to specific securities, investment programs or funds are for illustrative purposes only and are not intended to be, and should not be interpreted as recommendations to purchase or sell such securities.

This presentation does not discuss, directly or indirectly, the amount of the profits or losses realized or unrealized, by any CMG client from any specific funds or securities. Please note: In the event that CMG references performance results for an actual CMG portfolio, the results are reported net of advisory fees and inclusive of dividends. The performance referenced is that as determined and/or provided directly by the referenced funds and/or publishers, has not been independently verified, and does not reflect the performance of any specific CMG client. CMG clients may have experienced materially different performance based upon various factors during the corresponding time periods. See in links provided citing limitations of hypothetical back-tested information. Past performance cannot predict or guarantee future performance. Not a recommendation to buy or sell. Please talk to your advisor.

Information herein has been obtained from sources believed to be reliable, but we do not warrant its accuracy. This document is general communication and is provided for informational and/or educational purposes only. None of the content should be viewed as a suggestion that you take or refrain from taking any action nor as a recommendation for any specific investment product, strategy, or other such purposes.

In a rising interest rate environment, the value of fixed-income securities generally declines, and conversely, in a falling interest rate environment, the value of fixed-income securities generally increases. High-yield securities may be subject to heightened market, interest rate, or credit risk and should not be purchased solely because of the stated yield. Ratings are measured on a scale that ranges from AAA or Aaa (highest) to D or C (lowest). Investment-grade investments are those rated from highest down to BBB- or Baa3.

NOT FDIC INSURED. MAY LOSE VALUE. NO BANK GUARANTEE.

Certain information contained herein has been obtained from third-party sources believed to be reliable, but we cannot guarantee its accuracy or completeness.

In the event that there has been a change in an individual’s investment objective or financial situation, he/she is encouraged to consult with his/her investment professional.

Written Disclosure Statement. CMG is an SEC-registered investment adviser located in Malvern, Pennsylvania. Stephen B. Blumenthal is CMG’s founder and CEO. Please note: The above views are those of CMG and its CEO, Stephen Blumenthal, and do not reflect those of any sub-advisor that CMG may engage to manage any CMG strategy, or exclusively determines any internal strategy employed by CMG. A copy of CMG’s current written disclosure statement discussing advisory services and fees is available upon request or via CMG’s internet web site at www.cmgwealth.com/disclosures. CMG is committed to protecting your personal information. Click here to review CMG’s privacy policies.