November 22, 2024

By Steve Blumenthal

“If you are not aggressive, you are not going to make money, and if you are not defensive, you are not going to keep money.”

– Ray Dalio, Founder, CIO Mentor, and Member of the Board Bridgewater Associates

It’s hard to believe we’ve landed on November 22 already. You witnessed something remarkable if you caught last night’s Browns-Steelers game and managed to stay up for that snow-dusted finish. The Steelers, trailing 18-6 in the second half, clawed their way back with two quick touchdowns to take a 19-18 lead. For a while, it looked like that comeback might hold.

Then, with just 57 seconds left, Nick Chubb delivered the dagger—a two-yard run in slippery, snow-covered conditions to seal a dramatic win for Cleveland. Watching him dance through two inches of fresh powder across the goal line, it is clear: winter is knocking.

I’ll keep this week’s post brief as we sip our coffee and settle into the day. I’ve been diving into Ray Dalio’s “What’s Coming” post this week, and his quote above captures the delicate balance we face as investors. Aggression fuels growth, but without defense, gains quickly slip away. This balancing act of risk and reward—layered with probabilities—keeps us all in the game.

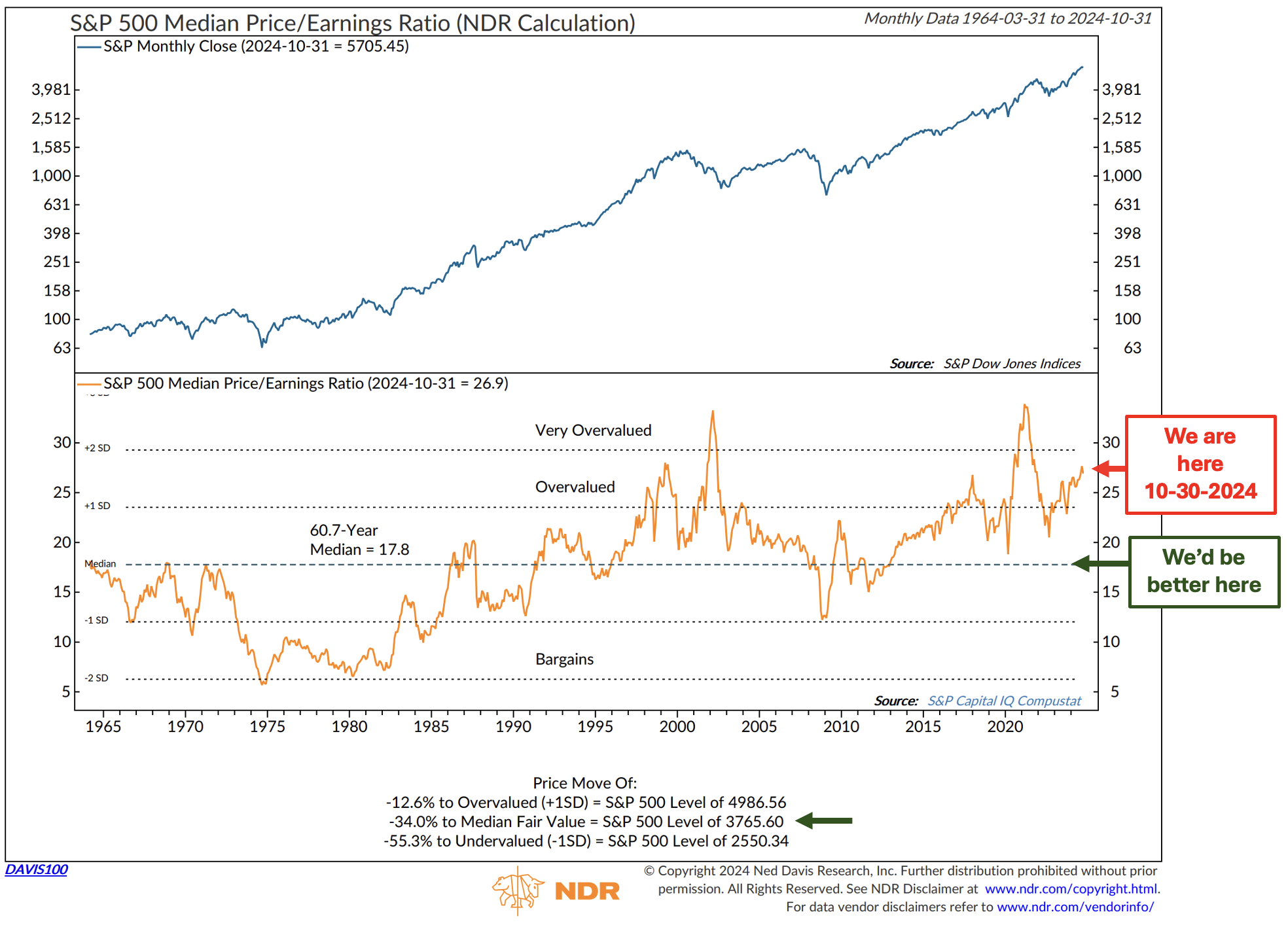

In the sections below, I share a few takeaways from Dalio’s recent insights and a few charts from this week’s Trade Signals post. It starkly illustrates where the S&P 500 Index stands today versus its historical “median fair value” over 60.7 years. Spoiler: the current level is sitting about 34% above that median. There is plenty to chew on as we navigate the crossroads of opportunity and caution.

On My Radar:

- What’s Coming: The Changing Domestic and World Orders Under the Trump Administration – Ray Dalio

- Major Issues Facing Investors in the Years Ahead, Bridgewater CIO’s

- Trade Signals: November 13, 2024 Update

- Personal Note: Black Friday Scramble

See Important Disclosures at the bottom of this page. Reminder: This is not a recommendation to buy or sell any security. My views may change at any time. The information is for discussion purposes only.

If you like what you are reading, you can subscribe for free.

What’s Coming: The Changing Domestic and World Orders Under the Trump Administration

By Ray Dalio, Founder, CIO Mentor, and Member of the Board Bridgewater Associates

First, I share my bullet point summary notes today with you objectively and without judgment. Picture yourself sitting at a Bridgewater investment committee meeting and simply taking in and assessing the discussion.

Big picture, top-down, here is a quick summary of Ray Dalio’s post.

Summary:

Ray Dalio outlines the likely trajectory of domestic and international policies under a Trump-led administration.

- Domestically, he envisions sweeping reforms aimed at efficiency, deregulation, and nationalistic priorities, with a government overhaul likened to a corporate restructuring.

- Internationally, the focus shifts to an “America First” agenda, characterized by economic and geopolitical competition with China and a departure from the post-WWII global order.

Dalio compares this shift to historical hard-right movements in the 1930s, emphasizing its implications for global alliances, national priorities, and investor strategies. He carefully pointed out that he doesn’t believe the new administration is fascist in any way. Looking at history over the last 500 years, there have been common turning points, and today’s situation is sadly similar to the 1930s. He notes the potential for short-term market stimulation but warns of challenges tied to nationalism, protectionism, and global fragmentation.

Key Points for Investors to Focus On:

Domestic Policy Changes:

- Government Overhaul: Expect deep structural reforms aimed at increasing efficiency, reducing regulation, and slashing costs.

- Economic Prioritization: Industrial policies favoring productivity and efficiency over social issues like environmental care and equity.

- Deregulation: Eased restrictions benefiting businesses, especially in tech, AI, and industries impacted by tariffs or environmental policies.

- Infrastructure and Technology: Onshoring production (e.g., semiconductors) and reducing dependency on foreign adversaries.

- Healthcare Reforms: Radical restructuring of the healthcare system with significant implications for the sector.

- Capital Flows: Eased financial constraints and potentially stimulative monetary policies from a pressured Federal Reserve.

International Policy Changes:

- Geopolitical Strategy: “America First” agenda driving alliances, with China positioned as the primary adversary.

- Shift from Multilateralism: A move from a global, rules-based order to a fragmented, interest-driven model.

- Global South Dynamics: Opportunities in nonaligned, financially strong, and geopolitically stable countries.

- Tariffs and Trade Policy: Reforms aimed at protecting domestic industries while simultaneously generating revenue.

Macro Trends to Watch:

- Market Winners: Industries tied to deregulation, industrial policies, and national security (e.g., tech, defense, energy).

- Inflationary Pressures: Potential increase in government spending on strategic industries and infrastructure.

- Volatility: Political and policy-driven market swings, especially in tech, healthcare, and regulated sectors.

- Alliances and Trade: Impacts of realigned global partnerships on multinational corporations and international trade.

Dalio highlighted the Global South (developing nations accounting for roughly 85% of the world’s population) as an increasingly significant player in the shifting world order. Key points about the Global South include:

- Alignment Choices:

- The Global South is less likely to align with the U.S.-led “America First” agenda.

- These nations are more economically tied to China, which is perceived as more adept at exerting soft power and fostering economic relationships.

- Neutral or nonaligned countries in the Global South will navigate opportunities presented by the U.S.-China rivalry.

- Opportunities for Neutral Nations:

- Nonaligned financially strong countries with good internal order and productive capital markets are poised to benefit from the new global dynamics.

- Such nations can leverage their neutral stance to gain business and geopolitical advantages in a fragmented world.

- Implications for Global Influence:

- The U.S.’s declining role as a unified global order leader creates space for the Global South to assert its own path.

- With its growing economic power and influence, China is in a stronger position to win allies in this region than the U.S.

Dalio implies that the Global South’s alignment, or lack thereof, will significantly influence global economic and geopolitical outcomes in the years ahead.

Investment Strategies:

- Focus on Sectors Benefiting from Deregulation: Technology, industrials, defense, and energy.

- Monitor Onshoring Trends: Companies involved in domestic production and supply chains may benefit.

- Evaluate Geopolitical Risks: Stay informed on U.S.-China dynamics and their ripple effects on global markets.

- Identify Winners in Nonaligned Markets: Look for growth in financially stable and geopolitically neutral countries.

- Hedge Against Volatility: Expect market disruptions tied to policy uncertainties and geopolitical developments.

SB here: I want to include a look back at Ray’s Five Major Forces and consider the above with this context in mind.

The Five Major Forces

“It is readily apparent that the world order is changing

1) within countries via the moves toward increasingly extreme and polarized sides on the hard right (almost neo-fascism) and hard-left (almost neo-socialism/communism) that are squaring off as they move increasingly toward neo-civil war,

2) between countries via the increasing conflicts that are leading the major powers (and their smaller power allies) to align into neo-allied and neo-axis sides in neo-cold wars with neo-hot wars on the horizon,

3) with the classic big debt bubble/bust cycle approaching its late and more turbulent stage,

4) in the increasing disruptive acts of nature, and

5) impactful new technologies emerging.

All these things have happened together many times before for basically the same reasons, though of course no two are exactly the same and what is happening now reflects the contemporary versions of these influences.

I believe that it is really important to know how this Big Cycle works in order to understand both what is now happening and what might happen.

For reasons explained in much greater depth in my book and YouTube video, both titled “Principles for Dealing with the Changing World Order,” the world operates like a highly cyclical perpetual motion machine to produce the events that happen. In the book and video animation, I provided a template that I use to compare actual developments to help me see and anticipate what will happen. By and large, actual events are transpiring in a way that is consistent with the template for logical reasons. Note: The views I express in this post are my own and aren’t a reflection of the views of Bridgewater.”

If you want to watch the video on What’s Coming, click on the image.

With the above noted, let’s take a quick coffee break and return to the conference room. We’ll jump into the second half of today’s meeting with a quick summary from Bridgewaters’ CIOs.

You can read Ray’s full post on LinkedIn by clicking the photo. Source: Dalio, LinkedIn

Major Issues Facing Investors in the Years Ahead, Bridgewater CIO’s

Why you may want to speed read my bullet point summary notes (below to photo link to video recording) and/or listen to the recording:

Bridgewater Associates is a prominent American investment management firm. Some key points about Bridgewater:

- Bridgewater is one of the world’s largest hedge fund managers, with over $150 billion in assets under management as of 2022. Ray Dalio, its founder, is considered one of his generation’s most successful and influential investors.

- Bridgewater is known for its systematic, data-driven investment approach and its focus on macroeconomic analysis.

- In addition to Greg Jensen, who was mentioned as the Co-CIO, other key figures at Bridgewater include Bob Prince, the Co-CIO, and David McCormick, the former CEO.

GIC is the sovereign wealth fund of the Government of Singapore. Some key points about GIC:

- GIC was established in 1981 to manage Singapore’s foreign reserves. It is one of the largest sovereign wealth funds in the world, with an estimated $744 billion in assets under management as of 2022.

- GIC invests globally across various asset classes, including public equities, fixed income, real estate, private credit, and private equity.

- The organization is led by Lim Chow Kiat, who serves as the Group Chief Executive Officer.

For speed readers looking for highlights from the meeting, the following are my bullet point notes:

Overview: Bridgewater and GIC discussed the critical issues for investors, including U.S. exceptionalism, AI, China’s economy, and sustainable investing.

Key Takeaways

- U.S. exceptionalism in asset performance may be challenging to sustain due to high valuations and expectations

- AI revolution is likely in its early stages, with the potential for significant productivity gains but also regulatory risks

- China faces cyclical and structural economic challenges, requiring a shift in the growth model. Debt is a significant problem

- A sustainable investing approach should focus on real-world impact and nuanced transition strategies

U.S. Exceptionalism – Economic performance has been strong, but asset performance has been exceptional.

Factors that contributed to exceptionalism:

- Large domestic market, rules of laws, and deep capital market structure allow for economies of scale

- Diverse population fostering innovation

- Responsive policymaking

- Falling interest rates and taxes since 2009

- Innovation in sectors with network effects

Challenges for continued exceptionalism:

- Valuations have grown beyond the fundamentals

- There exists high expectations for future earnings growth

- Companies will need to double those growth expectations to justify current high valuations. A tall task – unlikely to occur

- Dollar strength potentially reversing

- Fiscal sustainability concerns include high government deficits, high government debt, growing costs to finance debt, and entitlement costs

The Artificial Intelligence (AI) Revolution

- AI’s impact on the real economy is still in the early stages

- Potential for significant productivity gains across sectors

AI Challenges:

- Regulatory risks and potential international pushback

- Need for companies to adapt and customize AI tools

- Talent scarcity for AI implementation

AI Investment implications:

- Differentiation between companies able to leverage AI effectively

- Potential for new companies to emerge adapting AI for specific industries

China’s Economic Challenges

- Growth rate declined from 10.4% (2000-2010) to 4.7% (2020-2023)

- Factors contributing to China’s slowdown:

- Subdued post-COVID recovery

- Demographic shifts – aged population

- Policy shift towards quality over quantity growth

- Structural deleveraging, especially in real estate

- Rising geopolitical tensions

Investor considerations:

- Potential for unstable equilibrium and deflationary risks

- Opportunities in specific companies despite overall economic challenges

SB side note – I avoid investing in China for geopolitical reasons.

GIC’s investment strategy across the sustainability spectrum:

- Green assets: Scale up decarbonization solutions

- Transition assets: Engage and support companies in decarbonization efforts

- High-carbon assets: Divest from those unwilling or unable to transition

Conclusion:

- Continue monitoring U.S. exceptionalism and potential shifts in global capital flows

- Track AI development and identify companies best positioned to leverage the technology

- Closely watch China’s economic transition and policy responses

- Implement nuanced sustainability strategies across different asset classes and regions

Not a recommendation to buy or sell any security. For discussion purposes only. Current viewpoints are subject to change.

Understanding Private Credit

The CMG Private Wealth Private Credit White Paper provides an in-depth analysis of private credit investments, exploring their potential benefits and associated risks. It offers insights into market trends, investment strategies, and the role of private credit in diversified portfolios. This resource is valuable for investors seeking to understand the nuances of private credit and its place in the current financial landscape.

If you’d like to learn more, you can sign up to receive the paper for free here.

Market Commentary:

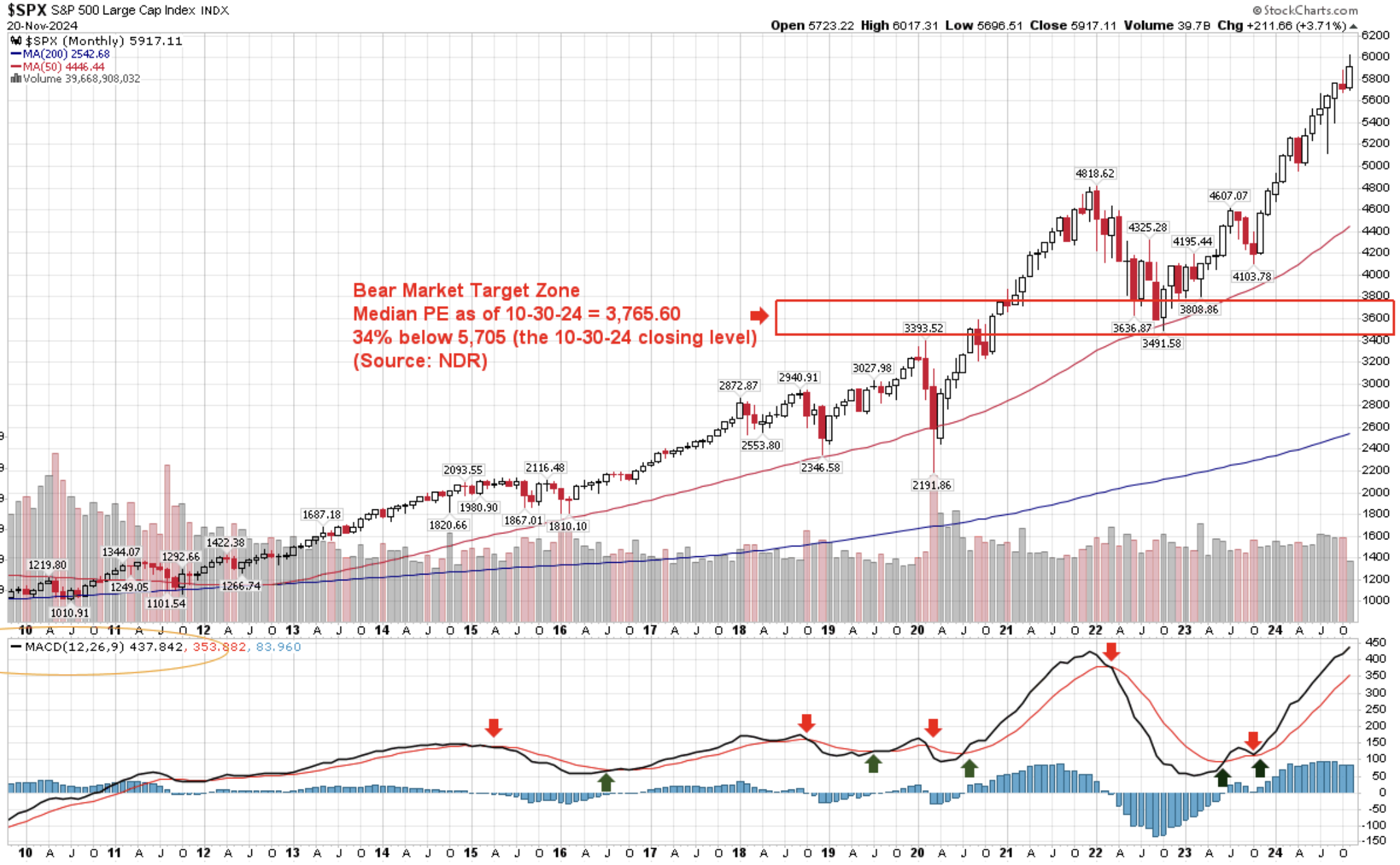

The U.S. stock market trend remains bullish. The following chart examines the monthly MACD, a longer-term, slow-moving, trend-based indicator. I’ve drawn a red rectangle indicating NDR’s Median PE target at 3,765.60 as of November 30, 2024. This is a reasonable “Fair Value” target for investors to set in the fear that will present in the next bear market.

Source: StockCharts.com

Here’s a look at Median PE (explanation in the valuation section further below) :

Source: Ned David Research

Two other notable equity market signals to watch: 1) Don’t Fight the Fed and Tape indicator signaled a -1 bear signal. It had been in a bull signal for 47 months, source: NDR. 2) the S&P 500 Weekly MACD remains bullish but is nearing a bear signal. The S&P 500 Daily MACD just turned bearish, as seen in the following chart. (For trading purposes, I favor the Weekly MACD (further below) and use the Daily as an early warning of a change in trend.)

Source: Stockcharts.com

Overall, the long-term U.S. equity market trend remains bullish. There are more buyers than sellers as measured by actual volume demands vs. volume supply (chart and details below in Trade Signals chart section), and our other long-term indicators remain bullish. However, the intermediate-term picture is turning bearish. Given the extremely high valuations (a Shiller PE of 37.73, the third highest reading since 1880 and nearing a 2021 high) and excessive investor optimism, maintaining a hedged defensive posture is advised.

Next is a look at the Shiller PE (note the long history to understand where we sit today). According to Investopedia, “The Shiller Price-to-Earnings (P/E) ratio, also known as the Cyclically Adjusted Price-to-Earnings (CAPE) ratio, is a valuation metric developed by economist Robert J. Shiller. It assesses whether the stock market is overvalued or undervalued by comparing current prices to average inflation-adjusted earnings over the past ten years. This approach smooths out short-term fluctuations, providing a more stable view of long-term earnings potential.”

Bottom line: Red Dot upper right in the chart = super expensive valuation.

Source: ShillerPE

If you are not a subscriber and would like a free sample, reply to this email, and we’ll send you this week’s post.

Trade Signals is designed for traders and investors seeking a better understanding of technical trends in various markets. Click on the link below to subscribe or login. The letter is free for CMG clients; reply to this email or contact your CMG rep.

TRADE SIGNALS SUBSCRIPTION ACKNOWLEDGEMENT / IMPORTANT DISCLOSURES

The views expressed herein are solely those of Steve Blumenthal as of the date of this report and are subject to change without notice. Not a recommendation to buy or sell any security.

Personal Note: Black Friday Scramble

“Thanksgiving is a time of togetherness and gratitude.”

– Nigel Hamilton

Stonewall Old Course #18 – Kyle, Ernesto (long-time friend and caddy), and Steve

There will be no On My Radar next week, as Stonewall will be hosting its annual Black Friday Golf Scramble—a tradition that’s as much about camaraderie as it is about competition. For those unfamiliar, a scramble format means each player hits their drive, and the team picks the best shot to play from. This process repeats until the hole is finished. In past years, the winning teams have gone a staggering 18 or more under par.

Stonewall itself is a gem. Nestled about 40 miles northwest of Philadelphia, it boasts two courses designed by the legendary Tom Doak, known for his minimalist approach. But it’s the Old Course that steals the spotlight—a challenging yet stunning layout that feels as if it was always meant to be part of the rolling Pennsylvania countryside.

For the Black Friday tournament, the greenskeeper leans into the fun (or frustration!) by setting the pins in tricky spots—think ridge lines where a slight miss sends your ball rolling off the green. Add a forecast calling for 32 to 40 degrees, and it promises to be an adventure. But with hats, hand warmers, hot chocolate, and perhaps a few other beverages to keep us warm, we’ll make the best of it.

I hope your Thanksgiving plans include time with the people who matter most. Susan and I are thrilled to have everyone home—nothing beats togetherness and the gratitude that comes with it.

Wishing you and your family a wonderful Thanksgiving filled with love, warmth, and laughter.

Ever forward,

Steve

You can share this letter on X by clicking here.

You can share this letter on LinkedIn by clicking here.

Subscribe to OMR for free by clicking the photo.

Stephen B. Blumenthal

Executive Chairman & CIO

CMG Capital Management Group, Inc.

Private Wealth Client Website – www.cmgprivatewealth.com

TAMP Advisor Client Webiste – www.cmgwealth.com

Forbes Book – On My Radar, Navigating Stock Market Cycles. Stephen Blumenthal gives investors a game plan and the advice they need to develop a risk-minded and opportunity-based investment approach. It is about how to grow and defend your wealth. You can learn more here.

Stephen Blumenthal founded CMG Capital Management Group in 1992 and serves today as its Executive Chairman and CIO. Steve authors a free weekly e-letter entitled, “On My Radar.” Steve shares his views on macroeconomic research, valuations, portfolio construction, asset allocation and risk management.

Follow Steve on Twitter @SBlumenthalCMG and LinkedIn.

IMPORTANT DISCLOSURE INFORMATION

This document is prepared by CMG Capital Management Group, Inc. (“CMG”) and is circulated for informational and educational purposes only. There is no consideration given to the specific investment needs, objectives, or tolerances of any of the recipients. Additionally, CMG’s actual investment positions may, and often will, vary from its conclusions discussed herein based on any number of factors, such as client investment restrictions, portfolio rebalancing, and transaction costs, among others. Recipients should consult their own advisors, including tax advisors, before making any investment decision. This material is for informational and educational purposes only and is not an offer to sell or the solicitation of an offer to buy the securities or other instruments mentioned. This material does not constitute a personal recommendation or take into account the particular investment objectives, financial situations, or needs of individual investors which are necessary considerations before making any investment decision. Investors should consider whether any advice or recommendation in this research is suitable for their particular circumstances and, where appropriate, seek professional advice, including legal, tax, accounting, investment, or other advice. The views expressed herein are solely those of Steve Blumenthal as of the date of this report and are subject to change without notice.

Investing involves risk.

This letter may contain forward-looking statements relating to the objectives, opportunities, and future performance of the various investment markets, indices, and investments. Forward-looking statements may be identified by the use of such words as; “believe,” anticipate,” “planned,” “potential,” and other similar terms. Examples of forward-looking statements include, but are not limited to, estimates with respect to financial condition, results of operations, and success or lack of success of any particular market, index, investment, or investment strategy. All are subject to various factors, including, but not limited to, general and local economic conditions, changing levels of competition within certain industries and markets, changes in legislation or regulation, Federal Reserve policy, and other economic, competitive, governmental, regulatory, and technological factors affecting markets, indices, investments, investment strategy and portfolio positioning that could cause actual results to differ materially from projected results. Such statements are forward-looking in nature and involve a number of known and unknown risks, uncertainties, and other factors, and accordingly, actual results may differ materially from those reflected or contemplated in such forward-looking statements. Investors are cautioned not to place undue reliance on any forward-looking statements or examples. All statements made herein speak only as of the date that they were made. Investing is inherently risky and all investing involves the potential risk of loss.

Past performance does not guarantee or indicate future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product (including the investments and/or investment strategies recommended or undertaken by CMG), or any non-investment related content, made reference to directly or indirectly in this commentary will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation or prove successful. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this commentary serves as the receipt of, or as a substitute for, personalized investment advice from CMG. Please remember to contact CMG, in writing, if there are any changes in your personal/financial situation or investment objectives for the purpose of reviewing/evaluating/revising our previous recommendations and/or services, or if you would like to impose, add, or to modify any reasonable restrictions to our investment advisory services. Unless, and until, you notify us, in writing, to the contrary, we shall continue to provide services as we do currently. CMG is neither a law firm, nor a certified public accounting firm, and no portion of the commentary content should be construed as legal or accounting advice.

No portion of the content should be construed as an offer or solicitation for the purchase or sale of any security. References to specific securities, investment programs or funds are for illustrative purposes only and are not intended to be, and should not be interpreted as recommendations to purchase or sell such securities.

This presentation does not discuss, directly or indirectly, the amount of the profits or losses realized or unrealized, by any CMG client from any specific funds or securities. Please note: In the event that CMG references performance results for an actual CMG portfolio, the results are reported net of advisory fees and inclusive of dividends. The performance referenced is that as determined and/or provided directly by the referenced funds and/or publishers, has not been independently verified, and does not reflect the performance of any specific CMG client. CMG clients may have experienced materially different performance based upon various factors during the corresponding time periods. See in links provided citing limitations of hypothetical back-tested information. Past performance cannot predict or guarantee future performance. Not a recommendation to buy or sell. Please talk to your advisor.

Information herein has been obtained from sources believed to be reliable, but we do not warrant its accuracy. This document is general communication and is provided for informational and/or educational purposes only. None of the content should be viewed as a suggestion that you take or refrain from taking any action nor as a recommendation for any specific investment product, strategy, or other such purposes.

In a rising interest rate environment, the value of fixed-income securities generally declines, and conversely, in a falling interest rate environment, the value of fixed-income securities generally increases. High-yield securities may be subject to heightened market, interest rate, or credit risk and should not be purchased solely because of the stated yield. Ratings are measured on a scale that ranges from AAA or Aaa (highest) to D or C (lowest). Investment-grade investments are those rated from highest down to BBB- or Baa3.

NOT FDIC INSURED. MAY LOSE VALUE. NO BANK GUARANTEE.

Certain information contained herein has been obtained from third-party sources believed to be reliable, but we cannot guarantee its accuracy or completeness.

In the event that there has been a change in an individual’s investment objective or financial situation, he/she is encouraged to consult with his/her investment professional.

Written Disclosure Statement. CMG is an SEC-registered investment adviser located in Malvern, Pennsylvania. Stephen B. Blumenthal is CMG’s founder and CEO. Please note: The above views are those of CMG and its CEO, Stephen Blumenthal, and do not reflect those of any sub-advisor that CMG may engage to manage any CMG strategy, or exclusively determines any internal strategy employed by CMG. A copy of CMG’s current written disclosure statement discussing advisory services and fees is available upon request or via CMG’s internet web site at www.cmgwealth.com/disclosures. CMG is committed to protecting your personal information. Click here to review CMG’s privacy policies.